Combined with the 30 percent federal solar tax credit the state incentive eliminated nearly half the cost of solar installations and reduced payback time to as little as five years in some cases.

2018 iowa solar tax credit.

Qualifying installations must meet the criteria for the federal energy efficient property credit related to solar energy provided in sections 48 a 3 a i and 48 a 3 a ii of the internal revenue code.

The system is designed so that once you have submitted an application you can later sign into the system to track its status.

The tax credit is capped at 5 million per year and has had a waiting list of applicants every year.

This report meets that requirement for 2018.

The state s solar tax credit is set to begin phasing out next year but a massive tax bill passed by the state senate last week would end the program on july 1.

The tax credit was.

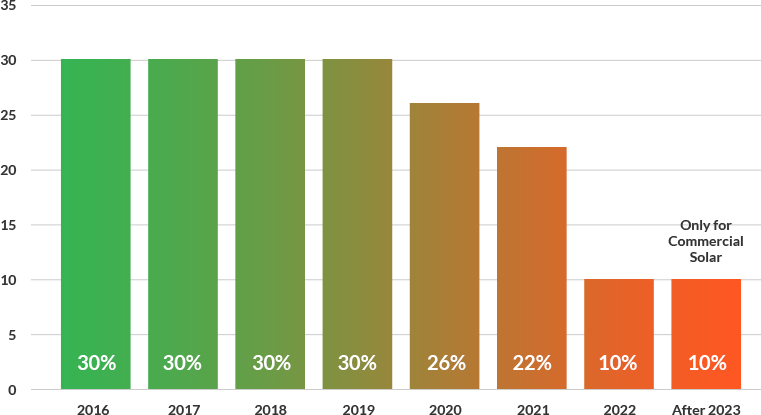

So for an average 6kw solar energy system installed for 18 000 you are eligible for 4 680 from the federal government 26 18 000 and an additional 2 340 50 of the federal credit.

Tax credit eligibility a solar energy system tax credit is available for taxpayers who install a solar energy system on property located in iowa.

A tax credit that s helped motivate many fiscally conscious iowa farmers to install solar panels would see an early demise under a sweeping tax reform.

Combined with the 30 percent federal solar tax credit the state incentive eliminated nearly half the cost of solar installations and reduced payback time to as little as five years in some cases.

Applications are due may 1 for installations completed by december 31 the previous year solar energy system tax credits the application for the tax credit is available online within the tax credit award claim transfer administration system cactas.

Iowa offers a personal tax credit equal to 50 of the federal solar tax credit of 26.

See iowa code section 422 11y.

When you purchase a solar energy system in iowa the equipment is exempt from sales tax under iowa s sales tax exemption for electrical generating equipment saving you 6 on your purchase price.

The tax credit is nonrefundable but any tax credit in excess of tax liability can be carried forward up to ten tax years.

The 1 2 billion tax cut bill slashes tax rates and eliminates most state tax credits including those for solar.

Installations that occur after january 1 2016 are equal to 50 of the federal credit up to 20 000.

The itc deducts 26 percent of the cost of your solar energy system from your taxes which means.

An application for the iowa credit for businesses cannot be made until the installation of the solar system is complete and the system is placed in service.

The tax credit is currently equal to 0 10 per gallon of e 15 sold during june july and august and 0 03 per gallon during the remaining months.

The credit became available on july 1 2011 and sunsets january 1 2018.

The bill is scheduled for a hearing monday in the house ways and means committee.

Iowa sales tax exemption.

The solar energy system tax credit is available for qualified installations at a residence or business located in iowa.

Iowa tax reform bill puts solar tax credit on the chopping block.